CRITERIA OF APPLICATION

- The employer is financially capable of employing a Helper. In general, for every Helper to be employed, the employer must have a household income of no less than HK$15,000 per month or asset of comparable amount to support the employment of a Helper for the whole contractual period ;

- The Helper and the employer shall enter into a standard Employment Contract (ID 407) ;

- The Helper shall only perform domestic duties for the employer as specified in the standard Employment Contract (ID 407) ;

- The Helper shall not take up any employment with any other person during his/her stay in Hong Kong ;

- The employer will pay the Helper a salary that is no less than the minimum allowable wage HK$4,520 as announced by the HKSAR Government. If no food is provided to the Helper, the agreed amount of food allowance should not be less than HK$1,075 per month ;

- The Helper shall work and reside in the contractual address only ;

- Employer shall provide a Helper with suitable accommodation and with reasonable privacy;

- The bona fides of the employer and the Helper are not in doubt ;

- There is no known record to the detriment of the employer and the Helper; and

- Employer is a bona fide Hong Kong resident.

DOCUMENTS REQUIRED

-

Employer's HKID card copy

If you are not a Hong Kong permanent resident, please make a copy of your travel document showing your personal particulars and the latest Hong Kong immigration stamp/visa.

-

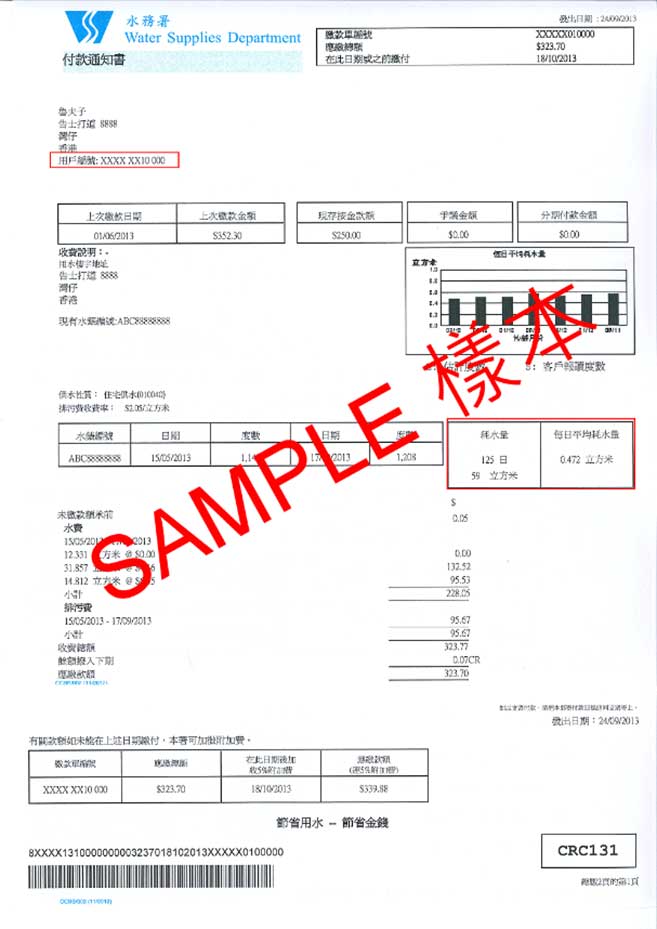

A copy proof of residence issued in the last 3 months (e.g. Bills for electricity, water, government rates, fixed telephone lines, cable TV);

- Employer's financial proof copy

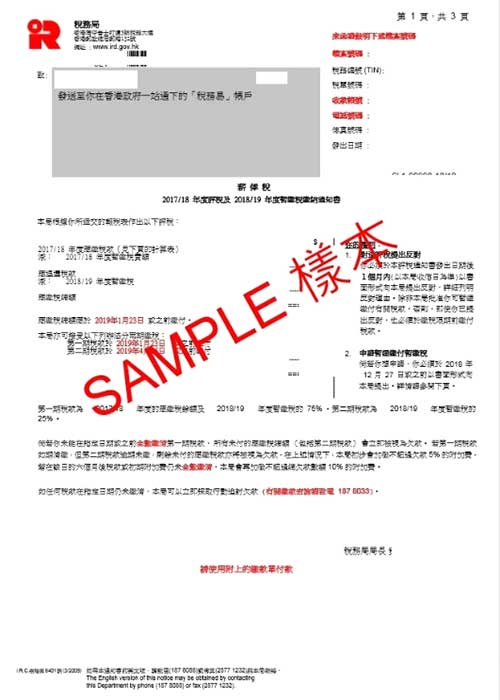

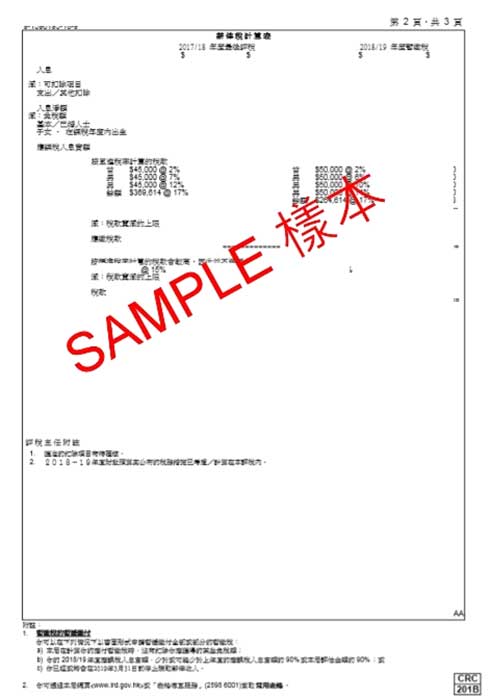

- An Assessment Demand Note issued by Inland Revenue Department for the current or last fiscal year (Page 1 & 2), showing an annual income HK$180,000 or above; or

- The last 3 months bank auto pay wage records; o

- Letter of Employment from a company with the evidence of payroll for at least 3 months and the monthly salary should be HK$15,000 or above; or

-

An evidence within the past 6 months showing a saving or fixed deposit of HK$360,000 or above; or

A copy of the marriage certificate or a copy of the birth certificate (If the proof of financial income or proof of address is different from the name of the employer);

- Current/last the helper’s name and HKID card number, date of termination of contract and limitation of stay in Hong Kong.

- The information of family member –Name & HKID card number & Year of birth

- The area of the employment address specified in the contract, the number of rooms, the arrangement of the helper (please specify whether the helper has a separate room, or the same room with a family member), and other domestic work requirements (such as wiping the car, taking care of pets, etc., please specify)

Methods of Selection for FDH

Philippines vs Indonesia

When selecting domestic helpers, the employer could also have considerations on many aspects based on the characters of domestic helpers from different countries in addition to the individual needs of each family.

|

Philippines |

Indonesia |

Education |

University/Junior college |

High school |

Language Skill |

English (High level) |

English / Cantonese (Simple level) |

Religion |

Catholic |

Moslem |

Training Period |

Around 14 days |

Around 3 months |

Submissiveress |

Lower |

Higher |

Overseas experience of housework |

Possess work experience in all countries |

Possess work experience in Singapore, Taiwan, Malaysia and Hong Kong |

Number of Maid in Hong Kong |

Around 150 thousand |

Around 150 thousand |

Comments |

Philippine maids' education are normally at high school level or above and with higher skill in English as English and Tagalog are their official languages. As Philippines is once governed by western countries for a long time, their living style and level is relative modern and advanced, and are easier to adapt and learn the living style in Hong Kong. Philippine maids are welcomed by most of Hong Kong employers mainly because they have strong adaptability and are able to help a little on children's English.

Major domestic helpers in Hong Kong are maids from Philippines, however following the increasing number in Hong Kong as well as the influence of partners from the same town, they are focusing too much on the contract terms with reduced submissiveress. It is also often to have 'picking employer', 'job-hopping' and 'shirking' as they have rich employment experiences in Hong Kong.

|

Indonesia domestic helpers are hard-working, honest , suffering, integrity and submissive. The Government of Indonesia is actively encouraging employment agency in providing more professional training and stricter examination on the work ability of household domestic helpers, which greatly improved the quality of Indonesia domestic helpers. Plus that many Indonesia domestic helpers have once worked in Singapore, where living condition is similar to Hong Kong, therefore Indonesia domestic helpers are increasingly welcomed by employers in Hong Kong. Employer usually believes that those Indonesia domestic helpers worked in Singapore will be good at housekeeping and hygiene. |

Overseas Maids vs Local Maids

Domestic helper from abroad is normally pure, industrious and highly submissive. As the domestic helper from abroad is the first time to work in Hong Kong without the impact from the habit of previous employer, the employer could instruct the domestic helper and create rules according to his own way, and the domestic helper will respect the employer more. By contrast, out-of-contract Instant domestic helpers have rich employment experience in Hong Kong, and are easy to adapt and learn the living style in Hong Kong. Therefore, it is also often to have ''picking employer', 'job-hopping' and 'shirking' occurred.

|

Overseas Maids |

Local Maids |

Application time |

3.5-4 months (subject to the visa approval) |

About 1-2 months (subject to the visa approval) |

No. of maids for selection |

More |

Less |

Reference |

Maid information and video |

Face-to-face interview |

Submissiveness |

Relatively high |

Relatively low |

Adaptability |

Relatively long |

Short (As they have rich employment experience in Hong Kong, easy to adapt and learn the living style in Hong Kong) |

Warranty of employment |

Six Months unlimited replacement of overseas and local overseas domestic helper with discount price

|

Six Months unlimited replacement of overseas and local overseas domestic helper with discount price

|

Going back to homeland for holiday |

After the 2-year contract |

Must take the holiday within first year of employment |

Tips for Selecting the Right Helper

-

Language Proficiency

Currently, Hong Kong families employ helpers primarily from the Philippines, Indonesia, and Thailand, and increasingly helpers from Myanmar. Most Filipinos can only communicate in English. However, Indonesians, Thais, and Myanmar helpers are trained in speaking Cantonese.

-

Age Consideration

Employers are free to choose helpers between age 18 and 50. The age of your helper can contribute to your family’s dynamics. If you have small kids, you may need someone who is between 30 and 40 years old and has the experience and energy to take care of children. For the teenagers in your family, you may need a younger helper in her 20’s who can communicate with them. Elderlies may appreciate the sympathy of a mature helper in her 50’s.

-

Study The Helper’s Background Carefull

You must scrutinize the helper’s background information and her expectation for her future employer’s family, so that both you and the helper are on the same page. Pay attention to whether her family situation really requires her to work in Hong Kong. This will become the factor that governs her work attitude and sense of responsibility.

-

Greenhorn Vs. Experienced Helper

Employers often wonder whether it’s best to employ a helper who is new to Hong Kong or already has experience in working in Hong Kong. According to some experts, those new to Hong Kong are generally more loyal and less demanding, but their lack of experience will require more training and grooming. The more experienced “local” helpers generally pick up work faster and show greater initiative. However, some of them might have been influenced by other “local” helpers and have accumulated bad habits.

-

Understanding Cultural Difference

Every country has its own cultural, religious, and social practices. You must understand their distinctive lifestyles and choose a helper who can match your own lifestyle. Some Indonesian helpers, due to religious reason, do not eat pork, and some of them cannot even touch pork. Some of them have to pray at certain times of the day. Employers are advised to be mindful of the helper’s customs.

Foreign domestic helper application process

Employers who employ overseas domestic helpers need to be approved or endorsed by the various government departments such as the Hong Kong Immigration Department, the consulate, the overseas labor department and the immigration office.

Applying for overseas helper takes about three months (in response to the consulate and immigration review and approval)

1. Choose your domestic helper

2. Sign up the employment contract

3. Submit documents to the consulate

4. Approval by Immigration Department

5. Collect the working visa and sent to the overseas helper

6. Arrange the overseas helper arrival to Hong Kong

Rest Days, Public Holidays, Annual Leaves

Please note that the information below is provided by the Hong Kong Labour Department.

REST DAYS

Employer shall provide a helper with not less than 1 rest day in every period of 7 days. A rest day is a continuous period of not less than 24 hours.

Statutory Holidays

All foreign domestic helpers, irrespective of their length of services, are entitled to the following 13 statutory holidays in a year -

The first day of January

Lunar New Years Day

The second day of Lunar New Year

The third day of Lunar New Year

Ching Ming Festival

Labour Day

The Birthday of the Buddha

Tuen Ng Festival

Hong Kong Special Administrative Region Establishment Day

The second day following the Chinese Mid-Autumn Festival

National Day

Chung Yeung Festival

Chinese Winter Solstice Festival or Christmas Day (at the option of the employer)

If the helper has worked continuously for the employer for three months preceding any of these holidays, he/she is entitled to the holiday pay.

https://www.labour.gov.hk/tc/news/latest_holidays2022.htm

Annual Leave

A helper is entitled to paid annual leave after serving every period of 12 months with the same employer. The helpers entitlement to paid annual leave will increase progressively from seven days to a maximum of 14 days according to the length of service as follows:

1 year of service – Helper is entitled to 7 days paid annual leave.

2 years of service – Helper is entitled to 7 days paid annual leave.

3 years of service – Helper is entitled to 8 days paid annual leave.

4 years of service – Helper is entitled to 9 days paid annual leave.

5 years of service – Helper is entitled to 10 days paid annual leave.

6 years of service – Helper is entitled to 11 days paid annual leave.

7 years of service – Helper is entitled to 12 days paid annual leave.

8 years of service – Helper is entitled to 13 days paid annual leave.

9 years of service and above – Helper is entitled to 14 days paid annual leave.

Day Off Q&A

1. Who determines the timing of annual leave taken by a helper?

A helper shall take the paid annual leave to which he/she is entitled within the following 12 months at a time appointed by the employer after consultation with the helper, confirmed by a written notice to the helper at least 14 days in advance.

2. Should annual leave include rest days and statutory holidays?

No. Any rest day or statutory holiday falling within the period of annual leave will be counted as annual leave. Another rest day or holiday must be appointed.

3. Should vacation leave be granted in addition to annual leave? Is it paid or unpaid?

Vacation leave of not less than seven days should be granted in addition to the helpers entitled annual leave. However, whether this vacation leave shall be paid or unpaid would depend on the term agreed in Clause 13 of the standard employment contract.

4. Can an employer compel his/her helper to take no pay leave when the employer is going aboard?

The arrangement of taking no pay leave shall be of mutual consent to both parties. The employer shall not unilaterally impose such leave on his/her helper.

5. What kinds of leave are foreign domestic helpers entitled to under the Employment Ordinance?

Under the Employment Ordinance, foreign domestic helpers are entitled to the following leave:

- Rest days

- Statutory holidays

- Paid annual leave

If both parties enter into a re-engagement contract, the helper shall, before the new contract commences, return to his/her country of origin at the expense of the employer for a vacation of not less than seven days according to the standard employment contract.

Leave pay and whether leave have been granted is a common cause of dispute between an employer and a helper. Leave and payment records should be kept properly to avoid future disputes.

6. How should I appoint rest day to my helper?

You should provide your helper at least one rest day in every period of seven days. A rest day is a continuous period of not less than 24 hours.

Rest days shall be appointed by you and may be granted on a regular or an irregular basis.Unless the rest days are on a regular basis, you should notify the helper his/her rest days before the beginning of each month.

7. Can I ask my helper to work on his/her rest day?

No. Except in unforeseen emergency, you shall not require your helper to work on his/her rest day. An employer who compels the helper to work on a rest day is in breach of the Employment Ordinance.

You may however, with the consent of your helper, substitute some other day for the appointed rest day. The substituted rest day must be granted within the same month and before the original rest day or within 30 days after it.

8. Can I ask my helper to perform duties after he/she returns home on his/her rest day?

You should not compel your helper to perform duties on his/her rest days. However, he/she may work voluntarily on his/her rest days.

9. Can I require my helper to work on statutory holidays?

Yes, but you have to give him/her:

- not less than 48 hours prior notice ; and

- an alternative holiday within 60 days before or after the statutory holidays.

10. Can I ask my helper to forfeit a statutory holiday in exchange for extra wages with his/her consent?

No. You must not make any form of payment to your helper in lieu of granting statutory holiday. An employer who contravenes this provision is liable to prosecution and, upon conviction, to a fine of HK$50,000.

11. If a statutory holiday falls on my helpers rest day, is it obligatory for me to grant him/her another holiday?

Yes. If statutory holiday falls on a rest day, a holiday should be granted on the day following the rest day which is not a statutory holiday.

12. How should I grant annual leave to my helper on completion or termination of employment contract??

When the employment contract is terminated, your helper should be given payment in lieu of any annual leave not yet taken in respect of every 12 months completed service. For more that three but less than 12 months services in every period of 12 months, your helper is entitled to pro-rata annual leave pay if the employment contract is terminated other than for the reason of summary dismissal due to his/her serious misconduct.

For Example, If your helper resigned or was dismissed after serving 18 months of services and he/she had not yet taken any annual leave, he / she should be given payment in lieu of annual leave for the first 12 completed months of service ( i.e. 7 days ), plus the pro rata sum in lieu of annual leave pay calculated to the days of employment ( i.e. 7 days + 3.5 days = 10.5 days ). However, if your helper is summarily dismissed due to his/her serious misconduct after serving 18 months, he/she would only be entitled to payment in lieu of annual leave for his/her first 12 months of service, i.e. 7 days.

Key points to consider upon termination of contract

According to the Standard Employment Contract, both the employer and the domestic helper have the right to terminate the contract by giving one month’s notice or paying one month’s salary in lieu of notice. Notice of Termination of a domestic helper must be submitted to the Immigration Department within seven days.

For more clarification on termination entitlements, please see the Foreign Domestic Helper Guide from the Labour Department or contact your local Labour Relations Division.

Click here for the standard Notification of Termination of Employment letter issued by the Hong Kong Immigration Department.

| By Mail |

Foreign Domestic Helpers Section, Immigration Department, 3/F, Immigration Tower, 7 Gloucester Road, Wan Chai, Hong Kong. |

| In-Person |

Receipt and Despatch Unit, Immigration Department, 2/F, Immigration Tower, 7 Gloucester Road, Wan Chai, Hong Kong. |

| By Fax |

2157 9181 |

| Enquiries |

2824 6111 |

Employers are also responsible for the following termination entitlements:

- Outstanding wages

- Wages instead of notice

- Any earned but unused annual leave

- Any untaken statutory holidays

- Long Service Pay (where appropriate)

- Severance Pay (where appropriate)

- Transport to place of origin

- Travel and Food Allowance

Outstanding Wages

Ensure that any outstanding wages are paid together with the termination entitlements of the worker.

Wages instead of Notice

If the domestic helper is not given a written one month’s notice of termination, you are required to pay one month’s wages instead of notice. If, on the other hand, the worker fails to give you one month’s notice, she will owe you one month’s wages instead of notice.

Annual Leave & Statutory Holidays

Any earned but unused annual leave and Statutory Holidays must be paid as part of the termination entitlements.

Long Service Pay

You will need to pay Long Service to the worker if the worker has worked for you for no less than 5 years under a continuous contract and if:

- The worker is not summarily dismissed due to bad conduct

- The contract is not renewed due to other reason than bad conduct

- The worker is certified as permanently unfit to work and resigns

- The worker dies

- The worker is not dismissed because of redundancy

TIPS: Long Service Payment is calculated with the following formula:

(Monthly Wages x 2/3) x Years of Service

*Service of non-completed full year is calculated on a pro-rata basis*

Severance Pay

Your worker is entitled to Severance Pay if:

- The worker has worked for you for no less than 24 months under a continuous contract

- The worker is dismissed because of redundancy

- The contract is not renewed because of redundancy

NOTE: A worker can only be entitled to either Long Service or Severance Payment. If the worker is dismissed because of redundancy, they are entitled to Severance Payment, but no Long Service Payment.

TIPS: Severance Payment is calculated with the following formula:

(Monthly Wages x 2/3) x Years of Service

*Service of non-completed full year is calculated on a pro-rata basis*

Transport to place of Origin

The employer is required to provide free passage to the worker’s place of origin, which is the address listed on the front page of the contract. This includes not only air travel but also any train, bus, car, etc., transport necessary.

Food and Travel Allowance

A food and travel allowance of HK$100 must be paid per day of travel.

Other reminders:

Does anything need to be signed?

Both the employer and the helper should sign a receipt confirming all payments made upon termination and both should keep a copy of the receipt.

Should a reference letter be provided?

Employers are not obligated to provide a reference letter. However, if you’ve had a good experience with your worker, a nice reference letter could greatly assist her/him in finding another job. If you do not feel like your worker deserves a good reference letter, you should feel no obligation to give her/him one.

Termination of contract Q&A

Please note that the information below is provided by the Hong Kong Labour Department.

1. Can an employer or a helper terminate the employment contract before it expires?

Yes, either party may terminate the contract by giving not less than one months notice in writing or by paying one months wages to the other party. A sample of the letter of termination is at Appendix III.

2. What the employer or helper should do when terminate the employment contract?

For Employer

- You should clear all outstanding wages and other sums due to your helper, preferabley by payment through the bank, and obtain a receipt for all payments.

- You are required to notify the Extension Section of the Immigration Department in writing of the termination within seven days of he date of termination. It is not necessary to inform the Labour Department.

For Helper

- You should clear all outstanding wages and other sums due to your employer, preferably by payment through the bank, and obtain a receipt for all payments.

- You are required to notify the Extension Section of the Immigration Department in writing of the termination within seven days of he date of termination. It is not necessary to inform the Labour Department.

3. Can an employer or a helper terminate the contract without notice or payment in lieu?

Termination without notice or payment in lieu is allowed only under special circumstances.

For Employer – You may summarily dismiss your helper without notice or payment in lieu of notice if your helper, in relation to the employment:

- willfully disobeys a lawful and reasonable order;

- misconducts himself/herself;

- is guilty of fraud or dishonesty; or

- is habitually neglectful of his/her duties.

For Helper – You may terminate your employment contract without notice or payment in lieu of notice if:

- you reasonably fear physical danger by violence or disease;

- you are subjected to ill-treatment by your employer; or

- you have been employed for not less than five years and you are medically certified as being permanently unfit for the type of work you are engaged.

4. What should I bear in mind when considering termination of the contract without notice?

- Termination of employment without notice is usually preceded by disagreement between the employer and the helper. In the midst of heated arguments, things may be blown out of proportions and either party may there and then believe that it is justified for him/her to terminate the contract or to consider that it has been terminated. This often turns out to be ill-conceived. As independent witnesses are not usually available in a domestic environment, it will be difficult to re-construst the circumstances leading to the dispute and decide whether the action taken is justified.

- The best way to solve problems arising from employment is for the parties to talk things out. Try to be considerate and tolerant with each other in sorting out your differences. Most problems can be resolved without resorting to drastic actions.

- Termination of employment without notice should be considered only under very special circumstances. If you really have to do so, you should make sure that you have sufficient evidence to back up your case. Otherwise, you will likely face a claim from the other party.

5. What should I do if my helper leaves without giving me notice or paymentn lieu? OR

What should I do if my employer dismisses me without giving me notice or payment in lieu?

- You should notify the Extension Section of the Immigration Department if you consider that the contract has been unilaterally terminated by the other party. For the employer, if you are unable to locate the whereabouts of the helper, you may also wish to report the case of missing helper to the Police.

- If you consider that the other party is not entitled to terminate the contract without notice and you wish to claim wages in lieu of notice, you should approach the appropriate branch office of the Labour Relations Division of the Labour Department without delay. This Division will help you settle your claim by conciliation.

- You may of course waive the requirement of proper notice from the other party.

6. Upon termination or expiry of the contract, what items of payment should I pay to my helper?

- The items and amount payable to your helper on termination or expiry of the contract depend on a number of factors such as the length of service and the reason for termination of contract. However, termination payments usually include:

– outstanding wages;

– wages in lieu of notice, if any;

– payment in lieu of any untaken annual leave, and any pro rata annual leave pay for the current leave year;

– where appropriate, long service payment or severance payment;

– any other sum due to the helper in respect of the employment contract.

e.g. free return passage and food and travelling allowance.

- It is advisable to keep the receipts for such payments.

Severance & Long Service Payment Q&A

Please note that the information below is provided by the Hong Kong Labour Department.

1. Under what circumstances should an employer pay severance payment to a helper?

An employer should pay severance payment to the helper if he/she:

- is dismissed or the fixed term contract is not being renewed* by reason of redundancy; and

- has not less than 24 months of service with the same employer immediately prior to the termination.

2. Under what circumstances should an employer pay long service payment to a helper?

An employer should pay long service payment to the helper if he/she has worked continuously for not less than five years, and:

- is dismissed or the fixed term contract is not being renewed* by reason of redundancy; and

- is certified by a registered medical practitioner as permanently unfit for the present job and he/she resigns.

- is aged 65 or above and he/she resigns; or

- dies in service.

3. Would a helper be entitled to severance payment and long service payment simultaneously?

No. A helper will not be simultaneously entitled to both long service payment and severance payment. A helper dismissed by reason of redundancy is entitled to severance payment but not long service payment.

4. How are severance payment and long service payment calculated?

The following formula applies to the calculation of both severance payment and long service payment:

(Monthly Wages x 2/3) x Years of Service

*Service of non-completed full year is calculated on a pro-rata basis*

(For details of calculation, please refer to the booklet “A Concise Guide to the Employment Ordinance”.)

* If not less than seven days before the date of dismissal / expiry of the fixed term contract in case of severance payment, and seven days before the expiry of the fixed term contract in case of long service payment, the employer has offered in writing to renew the contract of employment but the employee has unreasonably refused the offer, the employee in not eligible for the entitlements.

Free Return Passage & Food & Travelling Allowance Q&A

Please note that the information below is provided by the Hong Kong Labour Department.

1. What kind of air-ticket should I provide for my helper upon expiry or termination of contract? Should it be open-date or fixed-date?

This is not specified in the employment contract. Both parties may agree on an open-date or fixed-date ticket. However, you may wish to provide an open-date ticket in case your helper is unable to use ta fixed-date ticket due to unforeseen circumstances

2. How many days food and travelling allowance is payable to my helper under the employment contract?

It depends on the journey time between Hong Kong and your helpers place of origin provided that he/she travels by the most direct route. In general, if your helper is from an Asian country, one to two days food and travelling allowance should suffice.

3. Is my employer responsible for paying my passage back to my place of origin upon termination or expiry of the contract?

Yes. Upon termination or expiry of the contract, your employer should provide free passage, usually an air ticket covering airport tax for you to return to your place of origin, and a daily food and travelling allowance.